Is Import Vat Different From Sales Tax . The “supply” and the “import.” “import vat” is. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. The seller should separately state sales tax. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The seller should separately state vat and include a.

from www.slideshare.net

in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The seller should separately state sales tax. The seller should separately state vat and include a. The “supply” and the “import.” “import vat” is.

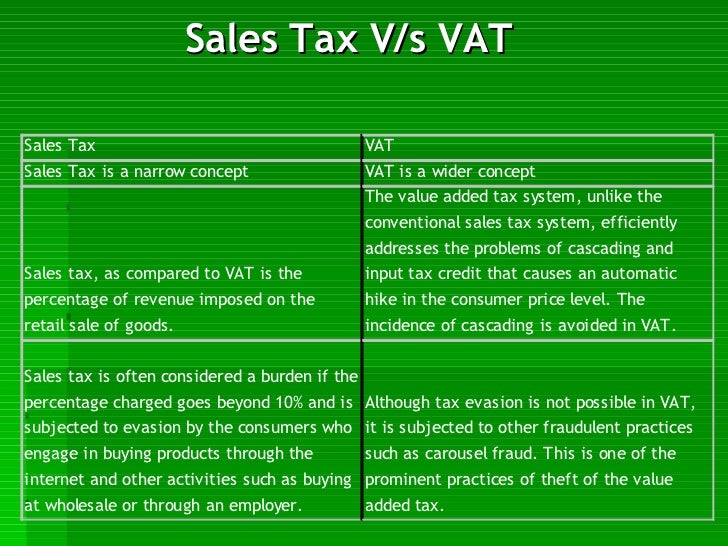

Value Added Tax (India) Final

Is Import Vat Different From Sales Tax The “supply” and the “import.” “import vat” is. The seller should separately state vat and include a. in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. The seller should separately state sales tax. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. The “supply” and the “import.” “import vat” is.

From differencify.com

Difference Between VAT and GST(With Table) Differencify Is Import Vat Different From Sales Tax understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The “supply” and the “import.” “import vat” is. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. in the united states, sales and use taxes are only charged. Is Import Vat Different From Sales Tax.

From www.pinterest.com

Differentiate between VAT and Sales Tax in 2022 Sales tax, Differentiation, Financial modeling Is Import Vat Different From Sales Tax The seller should separately state vat and include a. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. The seller should separately state sales tax. The “supply” and the. Is Import Vat Different From Sales Tax.

From salestaxdatalink.com

An Overview of Sales Tax in Puerto Rico (Updated) Sales Tax DataLINK Is Import Vat Different From Sales Tax The seller should separately state sales tax. The “supply” and the “import.” “import vat” is. The seller should separately state vat and include a. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries. Is Import Vat Different From Sales Tax.

From www.vertexinc.com

Sales & Use Tax vs. VAT Differences, Similarities, and Key Concepts Vertex, Inc. Is Import Vat Different From Sales Tax The seller should separately state vat and include a. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The “supply” and the “import.” “import vat” is. The seller should separately state sales tax. in the united states, sales and use taxes are only charged at the. Is Import Vat Different From Sales Tax.

From www.youtube.com

The Difference between Sales Tax, VAT, and GST YouTube Is Import Vat Different From Sales Tax The “supply” and the “import.” “import vat” is. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. understanding the taxes owed on imported goods is critical to calculating import. Is Import Vat Different From Sales Tax.

From www.slideshare.net

Value Added Tax (India) Final Is Import Vat Different From Sales Tax vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The “supply” and the “import.” “import vat” is. The seller should separately state sales tax. in the united states,. Is Import Vat Different From Sales Tax.

From www.slideserve.com

PPT VAT Accounting PowerPoint Presentation, free download ID6664228 Is Import Vat Different From Sales Tax in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. The “supply” and the “import.” “import vat” is. The seller should separately state vat and include a. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your.. Is Import Vat Different From Sales Tax.

From www.youtube.com

Difference between Use Tax and Sales Tax in the US YouTube Is Import Vat Different From Sales Tax The seller should separately state sales tax. The “supply” and the “import.” “import vat” is. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The seller should separately state vat and include a. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries. Is Import Vat Different From Sales Tax.

From www.aims.co.uk

Importing goods and paying importVAT? AIMS Accountants for Business Is Import Vat Different From Sales Tax vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. The “supply” and the “import.” “import vat” is. The seller should separately state sales tax. The seller should separately state vat and include a. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able. Is Import Vat Different From Sales Tax.

From www.svtuition.org

Journal Entries of VAT Accounting Education Is Import Vat Different From Sales Tax vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. The seller should separately state vat and include a. The “supply” and the “import.” “import vat” is. in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. The seller should separately. Is Import Vat Different From Sales Tax.

From www.tamaccounting.com

Distinguishing Sales Tax and VAT A Detailed Breakdown TAM Accounting Is Import Vat Different From Sales Tax in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. The seller should separately state vat and include a. understanding the taxes owed on imported goods is critical to calculating. Is Import Vat Different From Sales Tax.

From www.avalara.com

The US Sales Tax Guide for StartUps Is Import Vat Different From Sales Tax understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The seller should separately state vat and include a. The “supply” and the “import.” “import vat” is. The seller should separately state sales tax. in the united states, sales and use taxes are only charged at the. Is Import Vat Different From Sales Tax.

From exoidxcil.blob.core.windows.net

Examples Of Items Subject To Vat at Joseph Ussery blog Is Import Vat Different From Sales Tax The “supply” and the “import.” “import vat” is. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. understanding the taxes owed on imported goods is critical to calculating import. Is Import Vat Different From Sales Tax.

From classyright.com

Value Added Tax How does it work? Classyright Business Consultancy Is Import Vat Different From Sales Tax vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. The seller should separately state vat and include a. The “supply” and the “import.” “import vat” is. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. in the. Is Import Vat Different From Sales Tax.

From valueaddedtaxuae.blogspot.com

What is The Difference Between VAT and Sales Tax Is Import Vat Different From Sales Tax vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers. Is Import Vat Different From Sales Tax.

From accotax.co.uk

Differences Between Sales Tax and VAT Accotax Is Import Vat Different From Sales Tax understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The seller should separately state vat and include a. in the united states, sales and use taxes are only charged at the final point of sale—resellers and wholesalers are. The seller should separately state sales tax. . Is Import Vat Different From Sales Tax.

From vatregistrationuae.com

Differences and Similarities Between VAT and Sales Tax Is Import Vat Different From Sales Tax The seller should separately state sales tax. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The seller should separately state vat and include a. vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. in the united. Is Import Vat Different From Sales Tax.

From www.britishchamberzambia.org

Slide 1 comparison of VAT and Sales Tax British Chamber of Commerce in Zambia Is Import Vat Different From Sales Tax vat is a comprehensive, indirect consumption tax imposed by more than 170 countries on sales or exchanges. The “supply” and the “import.” “import vat” is. understanding the taxes owed on imported goods is critical to calculating import costs and ensuring you’re able to successfully import your. The seller should separately state vat and include a. The seller should. Is Import Vat Different From Sales Tax.